E-commerce Export magazine: Germany

11.9.2023Germans are the most complicated customers in the world according to many experts. Compared with other European countries, however, Germany can boast an above-average number of online customers. This country can be a challenge for exporting; therefore, the article presents all the important information you need to know before exporting there, from the biggest players in the German market through payment gateways to the country’s e-commerce trend.

One of the largest e-commerce markets in Europe

Germany is one of the largest markets in Europe. This parliamentary republic is divided into sixteen federal states and with its 84 million inhabitants is the 19th most populous country in the world. Germany is a major part of the Central European DACH region, which also includes Austria and Switzerland. It is one of the strongest economies in Europe and is a key member of the European Union, which is also part of the Schengen Area. The euro has been used here since 1999, when it replaced the German mark.

Size of the e-commerce market

The German market is the fifth largest e-commerce market in the world, and according to experts it has evolved over the past decade from a simple retail concept to a complex shopping ecosystem.

It is characterised by high internet penetration (81.5% in 2023), and up to 80% of customers most often shop using their smartphones. By law, customers have the right to cancel an order at any time or return goods within 14 days for any reason. Therefore, Germany is also known for its high rate of returns on goods and services, particularly in the fashion industry.

Growth in the past, growth in the future

During the pandemic years, from 2020 to 2021, the German e-commerce market saw growth increase by 24%.

As a consequence of measures associated with the pandemic, customers learned to buy goods online that they previously had only purchased in person (food or hygiene items). With 18% growth in 2022, the German market contributed to the global growth rate of 17%.

According to predictions, the compound annual growth rate should be 8.7% until 2027, and sales will continue to increase globally. A slight, gradual decrease in percentages symbolizes a slightly flooded market.

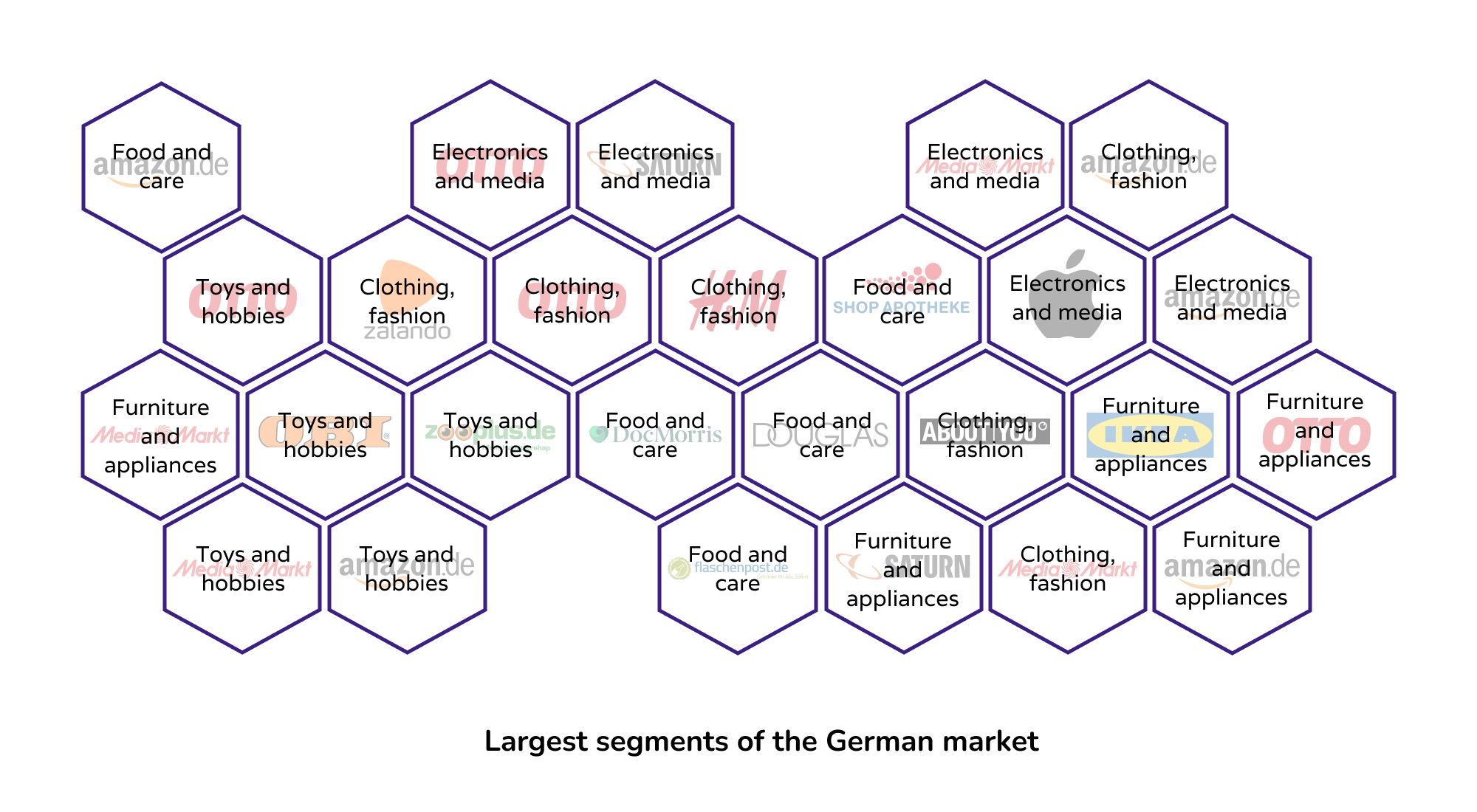

The biggest players on the German market

Companies offering goods from various segments are winning on the e-commerce market, and Internet shops with nationally focused sales have an important position. The three largest e-shops have a total share of up to 54.8% of the e-commerce in the country.

- Amazon.de – main category: electronics and media

- Otto.de – furniture and appliances

- Zalando.de – clothing, fashion

- Mediamarkt.de – electronics and media

- Saturn.de – electronics and media

Amazon is at the top in three out of five categories and is in the top five in each of them. Versatile nationally focused e-shops such as Otto.de, Mediamarkt.de or Saturn.de have a similar standing.

The largest segment of the market is clothing and fashion (accounting for 29% of German e-commerce revenues), followed, rather unconventionally, by food and personal care (18%) and furniture and appliances (18%).

Germans commonly buy from abroad, where China is the clear winner.

How do German customers behave?

Experts say that Germans can be considered the most complicated customers in the world.

Availability, convenience and home delivery – these are the three main reasons why German customers prefer to shop online. Up to 94% of German residents are active on the Internet, and 83% of them buy something online at least once a year. We also looked at their purchasing behaviour in more detail.

They prefer reliable and trustworthy merchants

For German customers, trust in the e-shop is fundamental. With e-commerce exporting, it is therefore recommended to:

- communicate reliably and do so with trust,

- adapt the e-shop to local shoppers (in addition to the German-language site, it is also ideal to use the national ending .de).

No trustworthy e-shop is lacking information about the owner, and various quality brands, badges and certificates are also to be considered.

They research and verify before buying

Germans have a tendency to thoroughly research a particular product before ordering it. They try to find detailed information and read customer reviews. German consumers are also known for having a certain scepticism towards adverts; they like to search for information about products and services themselves and verify it through other sources.

Quality is more important than price

Another specific feature of German customers is the preference for quality over price. Germans do not have problem paying extra for quality products, if they meet their demands and expectations. Unlike in Croatia or Poland, price is definitely not the most crucial factor when making a purchase. It is good to know, however, that consumers in Germany are most sensitive to amounts in the clothing and food industries, while sales of smartphones and shoes are most common in the case of luxury products.

High expectations for customer service

Like Austrians, Germans, too, expect a high level of services from online retailers. They need to feel that in case of any problem they can quickly and effectively contact the e-shop, and effective communication is also important in case of additional questions about goods and services.

Fast delivery and the possibility of returning goods

German customers expect fast and convenient delivery of orders with the opportunity to track the delivery’s progress. And it needs to be remembered that according to German law, consumers have the right to return goods within 14 days.

The chance to return goods applies to almost all products on the market, with the exception of hygiene products, event tickets, tailor-made goods, e-books and games. Exporting e-shops should anticipate in advance that the number of products returned from Germany will be higher than in countries without similar regulations.

Don’t underestimate the website’s responsiveness

At present, there are more than a hundred million active smartphones in Germany, which consumers often use for online shopping. Before entering the German market, don’t forget to optimise your website for mobile devices. After smartphones, laptops and tablets are the most often used devices.

Beware of frustration

Simple and reliable payments, comprehensive advice and quick problem solving. The expectations of Germans from e-shops are high, and customers can become frustrated very quickly. Dissatisfied customers regularly complain about false promises, unfulfilled expectations in the area of data protection and unqualified employees. Therefore, no area should be underestimated when entering the German market.

Payment gateways

As for payment methods, bank transfer is currently the winner in Germany, followed by online payments via an e-wallet or card. The most popular is PayPal. In the past, payment by invoice was also a favoured, and it still holds a place in the charts. According to forecasts, card payments should gradually decline in the future specifically at the expense of e-wallets.

| Payment gateway | Information about prices per month and payments |

| Barion | Prices for Barion (universal for Europe) |

| Fondy | Prices for Fondy (universal for Europe) |

| GoPay | Prices for GoPay (universal for Europe) |

| PayPal | Prices for PayPal (universal for Europe) |

| Paysera | Prices for Paysera (Germany) |

| PayU | Prices for PayU (universal for Europe) |

| Skrill | Prices for Skrill (Germany – after entering a filter) |

| Stripe | Prices for Stripe (Germany) |

| WSpay | Prices for WSpay (universal for Europe) |

Logistics

Germany is one of the most active logistics markets in the world, and not only because of its location in Central Europe. The country is characterised by a highly developed infrastructure, and its well-developed transport network and high-capacity airports ensure fast and reliable transport of goods.

For delivery, up to 77% of German customers prefer Deutsche Post DHL. Along with its courier services, this national carrier also provides Packstation parcel machines. Other favourites in logistics are UPS, DPD and GLS, and up to 20% of customers choose personal collection at the collection point.

| Courier company | Price for shipping |

| Deutsche Post DHL | Prices for Deutche Post DHL |

| UPS | Prices for UPS |

| DPD | Prices for DPD |

| GLS | Prices for GLS |

| Hermes | Prices for Hermes |

Legislation

With the German market, it is also necessary to know the basic legal standards in order to successfully run an e-shop.

- Strict consumer protection laws. Stricter laws apply in this area in Germany than in other countries; consumers have, for example, the right to information and the option to cancel the contract within a certain period.

- All the necessary information. Before sending an order and concluding the contract, it is necessary to provide the customer with basic information about the business (identity, address, contact) as well as the product, and it is also important to familiarise customers with the procedure for handling complaints.

- GDPR and data protection. In Germany, too, it is also important to follow the rules regarding the processing of personal data. Don’t forget about consent to data processing, implementing security measures or respect for the rights of individuals.

- Price transparency. Germany has strict price regulations; e-shops are obligated to display clear and accurate information about prices, including additional costs (taxes, customs duties or transport charges) and thus avoid misleading practices.

- Recycling and packaging materials. Specific German regulations also regulate the obligation to recycle, the use of ecological packaging materials and the environmentally responsible transport of goods. Special emphasis is placed on the disposal of electronic waste.

- Safety certified products. Products sold in Germany should be in harmony with the relevant safety standards, and if necessary also labelled with seals of certification.

Among the basic laws that you should be aware of in the field of e-commerce in Germany are the Telemedia act, the Privacy Act and the state Treaty on the Protection of Human Dignity and the Protection of Minors in Broadcasting and the Electronic Media. As a Member State of the European Union, all European general legal regulations apply in Germany, including the directive on electronic commerce.

VAT in Germany

In Germany a basic rate of value added tax (VAT) is used, which is currently 19% and applies to most goods and services. A reduced VAT rate of 7% applies to books, newspapers, medicines, some basic foodstuffs and cultural events. Tax rates may change depending on decisions of the German government or legislation.

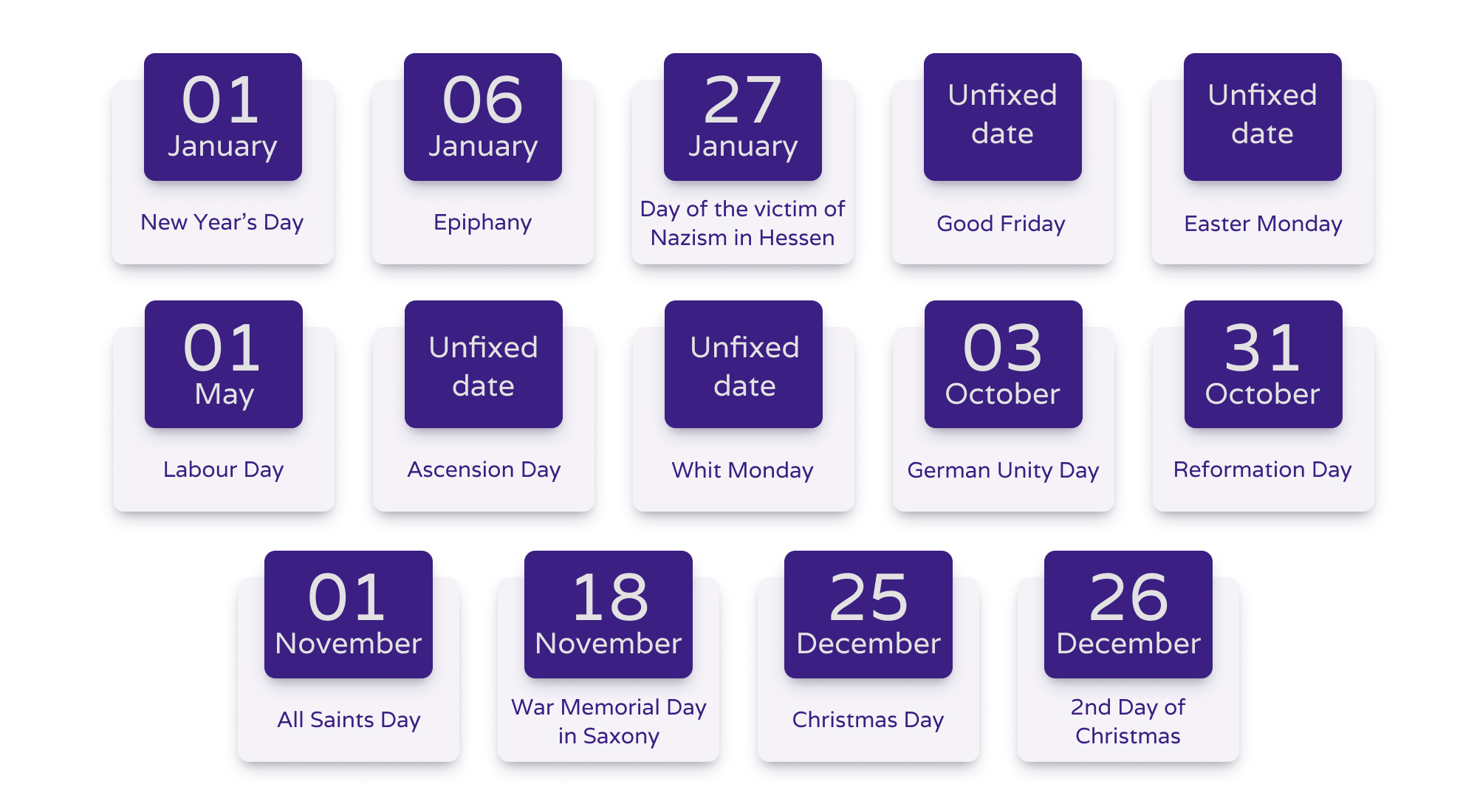

Overview of public holidays in Germany

State holidays in Germany are considered days of rest and relaxation for all citizens, so closed shops are also associated with them. The rule applies to most businesses, including retailers and shopping centres, with exceptions being stores at airports, train stations and tourist areas. It should also be noted that the rules and restrictions on opening hours during national holidays may differ in individual German states.

Online marketing

Online marketing is an important dynamic tool for achieving success in the digital environment in Germany, too. According to estimates spending on online advertising in Germany would reach more than 15 billion euros in 2023, while in 2022 it was 14.1 billion. Search advertising is the largest sector, followed by in-app, social networks, banner ads and video ads.

WhatsApp is the most popular social media in Germany. Overall, social networks were visited by almost 73 million users in 2022 in and in terms of the potential advertising reach on individual networks, YouTube is the winner, based on the rankings.

- YouTube (72.60 million users) – 86.5%

- Instagram (29.85 million users) – 35.6%

- Facebook (25.75 million users) – 30.7%

- TikTok (16.99 million users) – 24.4%

- SnapChat (15.30 million users) – 18.2%

- Facebook Messenger (14.35 million users) – 17.1%

- LinkedIn (13 million users) – 15.5%

- Twitter (7.75 million users) – 9.2%

As for the previously mentioned search advertising, which is popular in Germany, the dominant platform is Google Ads. Advertisers often target specific keywords relevant for their product offering. Search ads are displayed with a clear indication that they are advertising and usually follow a pay-per-click (PPC) model.

Price comparators

Germany also ranks among the European leaders in the field of price comparators. Online tools for discovering, searching and comparing products are exceptionally visited here, one of the largest comparators, Idealo.de, boasts almost 42 million visitors per month in Germany. Germans namely consider shopping on the Internet to be more economical or even more cost-effective thanks to the interesting offers of various e-shops. As already mentioned, they like to look for the lowest possible price and usually compare the prices at different shops before they send an order.

If you are planning to export to Germany, cooperation with these platforms is essential. You can use them to increase your visibility among new customers, identify your competitive advantages on the market and improve the reputation and credibility of your e-shop thanks to customer reviews and special quality marks.

The 6 largest price comparators and inspirational search engines

- Idealo.de – broad spectrum of products

- Geizhals.de – broad spectrum of products

- Mydealz.de – broad spectrum of products

- Landenzeile.de – broad spectrum of products

- Preis.de – broad spectrum of products

- Billiger.de – broad spectrum of products

Current trends on the market

Electronic shops in Germany are becoming more and more popular thanks to the continuous improvement of user experience, convenient cash-free payments and efficient shopping processes. Before exporting, you’ll certainly apply a few trends that have been driving the German e-commerce world in recent months (and will probably continue to do so in the future).

Popularity of online “marketplaces”

German consumers prefer convenience, so they typically choose to shop through aggregated catalogues and comparators rather than through a specific e-shop. This trend should only increase in the future, so working with these tools should not be underestimated. Many e-shops are already unable to compete with top online marketplaces with their functions and with the technological handling of increased traffic and meeting the expectations of new buyers.

The growing popularity of M-commerce

Among the key market trends in Germany is the growing popularity of M-commerce (mobile commerce), i.e. shopping through smartphones and tablets. Mobile shopping applications, which make it convenient and easy to search and order goods anytime and from anywhere, are becoming more and more popular among both retailers and customers.

Cooperation with influencers

It may be surprising, but research shows that many brands in Germany have a problem with creating quality content not only on the web, but also on social networks. That’s why a popular solution to this problem is cooperation with influencers, who can boast of experience in creating attractive content, as well as popularity and trust among their public. The basis of cooperation is the provision of free products or financial compensation.

Omnichannel marketing is becoming the new norm

Providing fluid customer experiences on various online and offline platforms on multiple devices – this is how to briefly describe omnichannel marketing, which in Germany is increasingly helping to satisfy customers’ need for convenient shopping. We also see this phenomenon in the new tools of major digital players (for example, Amazon Pinpoint or the new Google Analytics 4), which help to integrate communication and improve the customer experience across channels.

With its stability and above-average number of online customers, Germany may represent a great opportunity as well as a challenge for exporters. Are there any countries on your list to expand to? Write to us, and we’ll be happy to help you with this.